Wall Street’s Triple Whammy: NVIDIA Export Ban, Powell’s Warning, and Tech Selloff Rattle Markets

The U.S. stock market experienced a significant downturn on April 16, 2025, with all major indices closing sharply lower. This dramatic selloff was primarily triggered by NVIDIA’s announcement of export restrictions on its H20 chips to China, coupled with Federal Reserve Chairman Jerome Powell’s cautionary comments on tariff policies. As tech stocks led the decline, investors are now reassessing their market positions amid growing economic uncertainties. What does this market correction signal for global investors in the coming weeks?

Tech Sector Takes the Hardest Hit

The technology sector, particularly semiconductor companies, faced the brunt of the market downturn following NVIDIA’s regulatory disclosure.

- NVIDIA shares plummeted 6.90% after revealing potential costs of $5.5 billion due to export restrictions on H20 chips to China

- The semiconductor selloff was widespread with AMD falling 7.38% and Micron Technology dropping 2.48%

- This sector-wide decline highlights the increasing geopolitical risks affecting global technology supply chains

Powell’s Dual Warning Shakes Investor Confidence

The Federal Reserve Chairman’s comments dealt a double blow to market sentiment regarding inflation and intervention expectations.

- Powell explicitly warned that tariff policies could lead to both economic slowdown and increased inflation pressures

- His statements suggested the Fed might not provide a market “put” or safety net during market downturns

- These comments significantly dampened investor expectations for monetary policy support amid market volatility

Broader Market Impact Shows Deep Concerns

The selloff extended beyond tech stocks, indicating widespread investor anxiety about the economic outlook.

- The Dow Jones Industrial Average dropped 699.57 points (1.73%) to close at 39,669.39

- The S&P 500 fell 120.93 points (2.24%) to 5,275.70

- The tech-heavy Nasdaq Composite plunged 516.01 points (3.07%) to 16,307.16

- The fear gauge VIX jumped 8.67% to 32.73, reflecting heightened market uncertainty

Notable Stock Movers Amid the Selloff

Several individual stocks showed significant movement against the broader market trend.

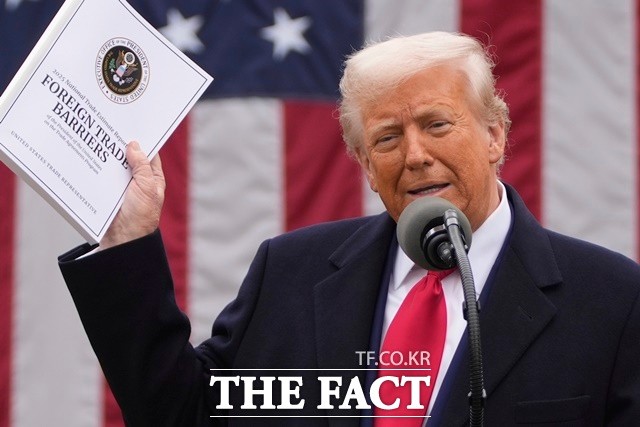

- Tesla shares declined 4.94% following reports that Trump’s tariff policies could disrupt production plans for Cybertruck and Semi electric vehicles

- Hertz Global saw a dramatic 56.44% surge after Pershing Square disclosed a new stake

- Travelers gained 1.13% after reporting quarterly earnings that exceeded Wall Street expectations

The dramatic market decline on April 16 serves as a stark reminder of the delicate balance between technological innovation, geopolitical tensions, and monetary policy. Investors would be wise to monitor how these three critical factors continue to interact in the coming months.

Keywords

NVIDIA, Jerome Powell, semiconductor export restrictions, market selloff

Hashtags

#WallStreetSelloff #TechStockDrop #FedPolicy

한국어 요약

- 2025년 4월 16일 미국 증시, 엔비디아의 H20 칩 중국 수출 제한과 파월 의장의 경고로 일제히 하락

- 엔비디아(-6.90%), AMD(-7.38%) 등 반도체 업체들이 큰 폭으로 하락하며 기술주 중심의 매도세 확산

- 파월 의장은 관세 정책이 경제 성장 둔화와 인플레이션 상승을 초래할 수 있다고 경고하며 시장 개입에 소극적 입장 시사

- 다우(-1.73%), S&P500(-2.24%), 나스닥(-3.07%) 모두 큰 폭 하락, VIX 지수는 32.73으로 8.67% 상승해 시장 불안감 반영