Gold-Covered Call ETF Delivers Exceptional 12.5% Return in Just One Month

Gold-Covered Call ETF Delivers Exceptional 12.5% Return in Just One Month

In a financial landscape marked by volatility and uncertainty, one investment vehicle has emerged as a standout performer. SOL Gold Covered Call Active ETF has delivered an impressive 12.5% return in just one month, significantly outperforming major market indices and catching the attention of investors seeking both growth and stability. What’s driving this exceptional performance, and could this signal a new trend in commodity-based investments?

A Golden Opportunity in Volatile Markets

This ETF combines gold exposure with an income-generating covered call strategy, offering a unique value proposition in today’s market conditions.

- The SOL Gold Covered Call Active ETF was listed on March 11, 2025, and has reached 11,250 KRW (approximately $8.03) as of April 21

- During the same period, the KOSPI index fell 3.19% and the S&P 500 declined 5.19%, making the ETF’s performance even more remarkable

- While physical gold prices rose 9.8% domestically, this ETF managed to outperform even the underlying asset by employing an active covered call strategy

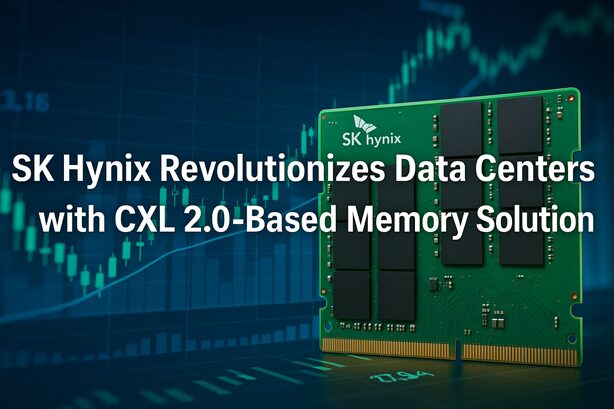

Strategic Asset Selection Powers Performance

The fund’s management approach includes careful selection of underlying gold ETFs from established markets with strong liquidity.

- The ETF constructs its portfolio by selecting 10-15 gold ETFs listed on U.S. and Canadian exchanges with assets under management (AUM) exceeding $30 million

- This strategic selection helps mitigate the “kimchi premium” often seen in Korean investments directly tracking foreign assets

- The fund aims to provide an annual dividend yield of approximately 4%, with the first monthly dividend distribution scheduled for May 2, 2025

Market Timing Enhances Returns

Global economic conditions have created an ideal environment for this innovative investment product.

- Kim Ki-deok, Head of Quant & ETF Management at Shinhan Asset Management, attributes the strong performance to increased global market volatility and declining dollar value

- The geopolitical tensions and inflation concerns globally have reinforced gold’s status as a safe-haven asset

- The covered call strategy allows the fund to generate additional income through option premiums while maintaining exposure to gold’s price appreciation

Investor Implications and Outlook

The ETF offers a compelling option for investors seeking both inflation protection and income generation.

- The combination of gold exposure and covered call strategy provides investors with a partial hedge against market volatility

- Monthly dividend distributions make this suitable for income-focused investors who also want commodity exposure

- Current market conditions of high volatility in equities markets and persistent inflation concerns may continue to support both gold prices and option premiums

The remarkable performance of the SOL Gold Covered Call ETF highlights the potential advantages of innovative financial products that combine traditional asset classes with income-generating strategies. As investors continue to navigate uncertain markets, products that offer both growth potential and income stability may become increasingly attractive.

Keywords

Gold ETF, Covered Call Strategy, Commodity Investment, Inflation Hedge, Monthly Dividend

Hashtags

#GoldETF #CoveredCallStrategy #AlternativeInvestments #InflationHedge #MonthlyDividends

한국어 요약

- SOL 골드커버드콜액티브 ETF가 한 달 만에 12.5%의 놀라운 수익률을 기록, 같은 기간 코스피(-3.19%)와 S&P 500(-5.19%)을 크게 상회함

- 이 ETF는 미국 및 캐나다 거래소에 상장된 AUM 3000만 달러 이상의 금 ETF 10~15개를 선별해 구성하며 김치 프리미엄 우려가 없음

- 연간 약 4% 배당을 목표로 하며, 첫 월배당은 2025년 5월 2일 예정

- 글로벌 금융시장 변동성 증가와 달러 가치 하락 같은 현재의 시장 환경이 금 가격 상승과 옵션 프리미엄 수익에 유리하게 작용