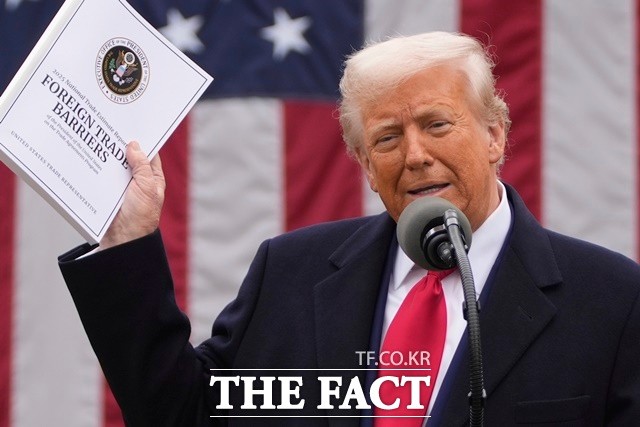

The Tariff War Threatening Dollar’s Safe Haven Status: What Korean Investors Need to Know

The escalating tariff war between the United States and China is increasingly undermining the dollar’s traditional status as a safe-haven asset. This geopolitical tension comes at a critical time for Korean retail investors—colloquially known as “Seo-hak-gae-mi” (Western stock ants)—who have heavily concentrated their portfolios in Nasdaq stocks. As market volatility increases, financial experts are urgently emphasizing the need for portfolio diversification beyond the American market. Could this be the perfect moment to reconsider your investment strategy?

Tariff War’s Ripple Effects

The U.S. tariff policies are significantly impacting Chinese markets while simultaneously increasing volatility in American equities.

- The ongoing trade tensions between the world’s two largest economies are creating unpredictable market swings

- Lee Ho-nyeon, head of ETF management at Mirae Asset Global Investments, identifies the current moment as an optimal entry point for investments in Chinese markets, particularly Hong Kong’s Hang Seng Tech

- Market analysts warn that the dollar’s reliability as a safe haven is diminishing as trade conflicts intensify

Diversification: The New Investment Imperative

Experts recommend moving beyond exclusive dependence on U.S. indices like Nasdaq and S&P 500 to include exposure to Chinese and European markets.

- Financial advisors suggest a 7:3 ratio between U.S. and Chinese investments for long-term portfolio stability

- This balanced approach aims to hedge against regional market volatility while capturing growth opportunities in multiple economic zones

- The strategy represents a significant shift from the U.S.-centric approach that has dominated Korean retail investment in recent years

China’s Market Potential

China’s government is actively transforming its economic policies to emphasize the role of private enterprises, creating potential long-term growth opportunities.

- Chinese authorities are implementing supportive measures for private businesses, marking a notable shift in economic governance

- Tech companies in China maintain powerful competitive advantages within their massive domestic market

- Government backing for strategic technology sectors is expected to continue, potentially boosting valuations in these areas

- The current undervaluation of Chinese tech stocks presents a compelling entry point for long-term investors

Recommended Investment Vehicles

Specific ETF products offer well-structured exposure to both American innovation and Chinese tech growth.

- The TIGER China Hang Seng Tech ETF provides focused access to Chinese tech giants, currently dominating approximately 80% of this market segment

- TIGER Global Innovation Blue Chip TOP10 offers a balanced portfolio spanning both U.S. and Chinese innovation leaders

- Key holdings in these funds include market leaders like Nvidia and Amazon from the U.S. and BYD and CATL from China

- These investment vehicles provide retail investors with professionally managed exposure to difficult-to-access foreign markets

The dollar’s position as the default safe-haven asset is facing unprecedented challenges in today’s complex economic landscape. As tariff conflicts escalate, Korean investors should seriously consider geographical diversification as a cornerstone of their investment strategy. The real question now becomes: how quickly can you rebalance your portfolio to adapt to this new reality?

Keywords

Tariff war, dollar depreciation, portfolio diversification, Chinese tech stocks

Hashtags

#GlobalInvesting #PortfolioDiversification #ChinaTech

한국어 요약

- 미중 관세 전쟁이 달러의 안전 자산 지위를 위협하고 미국 증시의 변동성을 증가시키는 상황

- 전문가들은 미국 나스닥에만 집중된 서학개미 투자자들에게 7:3 비율로 중국 시장 포함 자산 다변화 권장

- 중국 정부가 민간 기업 지원 정책을 강화하면서 중국 테크 기업들의 장기 성장 가능성 부각

- TIGER 차이나항셍테크 ETF와 TIGER 글로벌혁신블루칩TOP10 등이 다변화 투자 수단으로 추천됨