Korean Refiners Rush to Secure Billions Amid Oil Price Crash

The major Korean refiners are racing to secure substantial funding as global oil prices and demand continue their precipitous decline. HD Hyundai Oilbank, SK Innovation, and GS Caltex are all planning significant bond issuances to weather the storm hitting the refining sector. With WTI crude hovering in the low $60s and demand forecasts being slashed, how long can these industry giants maintain their financial stability in this challenging environment?

Massive Fundraising Efforts Underway

Korean oil refiners are collectively seeking to raise over 1.3 trillion won (approximately $950 million) through various financial instruments to strengthen their positions.

- HD Hyundai Oilbank plans to issue 250 billion won ($182 million) in private perpetual bonds

- SK Innovation is preparing to raise up to 800 billion won ($583 million) through public corporate bonds

- GS Caltex has initiated demand forecasting for corporate bonds worth up to 240 billion won ($175 million)

Perfect Storm of Market Pressures

The refining industry faces unprecedented challenges from both supply and demand sides of the equation.

- WTI crude prices have dropped to the low $60s, significantly reducing refining margins

- Major energy organizations have repeatedly downgraded oil demand forecasts for 2025

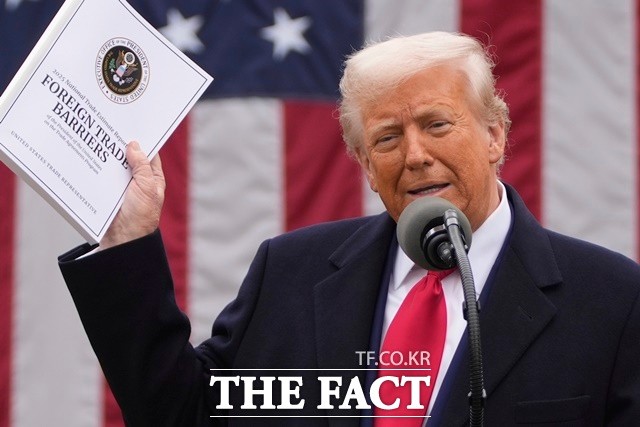

- Uncertainty is amplified by President Trump’s renewed trade war rhetoric, threatening global economic growth

Strategic Financial Maneuvers

These fundraising efforts represent calculated moves to maintain liquidity while positioning for an eventual market recovery.

- Companies are issuing hybrid securities that can be extended indefinitely at the issuer’s discretion

- This financial strategy allows refiners to increase capital while reducing debt on their balance sheets

- Bond issuance sizes are being carefully calibrated based on institutional investor demand to maximize available funding

Industry-Wide Implications

The refiners’ aggressive capital-raising suggests deeper concerns about the sector’s near-term prospects.

- These financial moves indicate refiners are preparing for a potentially prolonged downturn

- Companies with stronger balance sheets will be better positioned to weather the storm

- Industry consolidation could accelerate if current market conditions persist through 2025

The Korean refining industry’s scramble for capital highlights the growing concerns about global oil demand amidst economic uncertainty. While these financial maneuvers provide temporary breathing room, the fundamental question remains: will oil demand recover sufficiently to restore refining margins before these companies exhaust their financial options?

Keywords

Oil refiners, bond issuance, crude oil prices, energy market

Hashtags

#OilPriceCrash #RefineryFunding #EnergyMarkets

한국어 요약

- 국제유가 하락과 원유 수요 감소로 HD현대오일뱅크, SK이노베이션, GS칼텍스 등 주요 정유사들이 총 1.3조원 규모의 자금 조달에 나섬

- 서부텍사스산원유(WTI) 가격이 60달러 초반대로 하락하며 정유사 이익률이 급감하고 있으며, 주요 에너지 기관들은 2025년 원유 수요 전망을 계속 하향 조정 중

- 정유사들은 신종자본증권과 회사채 발행을 통해 자본을 확충하고 부채를 줄이는 재무 전략을 구사하고 있음

- 트럼프 대통령의 관세전쟁 우려로 글로벌 경제 성장에 대한 불확실성이 가중되며 정유업계의 자금 조달 경쟁은 더욱 치열해질 전망